It’s no secret that retiring in the U.S. can be pricey, but living out your golden years on a budget doesn’t mean sacrificing the dream of coastal living or sunny-year-round weather. There are plenty of cities where you can enjoy a warm climate and stick to a $2,000 monthly budget.

Find Out: How Far $1.5 Million in Retirement Savings Plus Social Security Goes in Every State

Check Out: Here's the Minimum Salary Required To Be Considered Upper Class in 2025

To find the best locations where homeowners could retire for around $2,000 or less, GOBankingRates looked at several sources to analyze factors such as population data, age demographics and cost of living.

AdvertisementAdvertisement#_R_21bckr8lb2mav5ubsddbH1_ iframe AdvertisementAdvertisement#_R_41bckr8lb2mav5ubsddbH1_ iframeHere are the top 25 cities where retirees can soak up the sunshine without stretching savings too thin.

Also see cities that retirees might want to avoid due to extreme weather.

RiverNorthPhotography / Getty Images

RiverNorthPhotography / Getty Images1. Tallahassee, Florida

Livability: 85

Population 65+: 11.4%

Monthly cost of living with Social Security for homeowner: $1,248

Monthly cost of living with Social Security for renter: $995

Tallahassee, the state’s capital city, is the ideal mix of exciting recreation and affordability. The cost of living is nearly 10% lower than the national average of $60,087 for a person over 65, and there’s everything from beautiful parks and hiking trails to a dynamic arts scene and nightlife to enjoy.

Also See: How Long $2 Million in Retirement Will Last in Every State

Learn More: How Much Money Is Needed To Be Considered Middle Class in Every State?

wildpixel / Getty Images/iStockphoto

wildpixel / Getty Images/iStockphoto2. Fort Myers, Florida

Livability: 85

Population 65+: 22.2%

Monthly cost of living with Social Security for homeowner:$1,746

Monthly cost of living with Social Security for renter: $1,468

AdvertisementAdvertisement#_R_24bckr8lb2mav5ubsddbH1_ iframe AdvertisementAdvertisement#_R_44bckr8lb2mav5ubsddbH1_ iframeWith its hassle-free public transportation, it’s easy to get around the area and enjoy the sights, go fishing, golf or lounge by the beach. While cost of living is 4.2% higher than the national average, retirees can save big on the state’s tax breaks for residents.

See More: How Long $1 Million in Retirement Will Last in Every State

Kruck20 / iStock.com

Kruck20 / iStock.com3. Raleigh, North Carolina

Livability: 84

Population 65+: 11.7%

Monthly cost of living with Social Security for homeowner: $2,037

Monthly cost of living with Social Security for renter: $1,069

From museums to lively bars and restaurants, there’s no shortage of things to do in Raleigh. Retirees can also take advantage of free activities like strolling through the Raleigh Rose Garden, wandering the scenic garden paths and exploring unique plant collections at Juniper Level Botanic Garden.

TraceRouda / Getty Images/iStockphoto

TraceRouda / Getty Images/iStockphoto4. Jacksonville, Florida

Livability: 84

Population 65+: 14.7%

Monthly cost of living with Social Security for homeowner: $1,197

Monthly cost of living with Social Security for renter: $1,073

AdvertisementAdvertisement#_R_26rckr8lb2mav5ubsddbH1_ iframe AdvertisementAdvertisement#_R_46rckr8lb2mav5ubsddbH1_ iframeJacksonville offers adventure, coastal living and a thrilling nightlife without breaking the bank. Cost of living is 4.3% lower than the national average, so retirees can worry less about blowing through their nest eggs.

Cheryl Casey / Shutterstock.com

Cheryl Casey / Shutterstock.com5. Pensacola, Florida

Livability: 83

Population 65+: 20.8%

Monthly cost of living with Social Security for homeowner: $929

Monthly cost of living with Social Security for renter: $1,136

With the cost of living 11% cheaper than the national average, plus the state’s tax breaks, retirees can enjoy the city’s beaches, upscale restaurants and thriving arts scene stress free.

Read More: 6 Cash-Flow Mistakes Boomers Are Making With Their Retirement Savings

Kruck20 / Getty Images/iStockphoto

Kruck20 / Getty Images/iStockphoto6. Greenville, South Carolina

Livability: 82

Population 65+: 15.1%

Monthly cost of living with Social Security for homeowner: $1,284

Monthly cost of living with Social Security for renter: $1,035

AdvertisementAdvertisement#_R_29bckr8lb2mav5ubsddbH1_ iframe AdvertisementAdvertisement#_R_49bckr8lb2mav5ubsddbH1_ iframeRetirees can enjoy Southern hospitality and a wide range of activities without overspending. Greenville’s cost of living is 8.7% below the national average, making it an affordable place to settle down.

georgeclerk / Getty Images

georgeclerk / Getty Images7. Las Vegas

Livability: 82

Population 65+: 15.6%

Monthly cost of living with Social Security for homeowner: $2,089

Monthly cost of living with Social Security for renter: $1,203

Las Vegas offers a nonstop good time and while the cost of living is 10.6% higher than the national average, you can save on healthcare. It’s 7% cheaper.

Alex Potemkin / Getty Images/iStockphoto

Alex Potemkin / Getty Images/iStockphoto8. Providence, Rhode Island

Livability: 82

Population 65+: 11.5%

Monthly cost of living with Social Security for homeowner: $1,908

Monthly cost of living with Social Security for renter: $1,707

AdvertisementAdvertisement#_R_2bjckr8lb2mav5ubsddbH1_ iframe AdvertisementAdvertisement#_R_4bjckr8lb2mav5ubsddbH1_ iframeProvidence has a nice blend of small-town feel with big-city attractions. The cost of living is 8.8% more than the national average, but healthcare is 12.7% lower.

Find Out: Here’s the Minimum Net Worth To Be Considered Middle Class in Your 60s

DenisTangneyJr / Getty Images

DenisTangneyJr / Getty Images9. El Paso, Texas

Livability: 81

Population 65+: 13.9%

Monthly cost of living with Social Security for homeowner: $712

Monthly cost of living with Social Security for renter: $975

The cost of living in El Paso is a whopping 18.1% lower than the national average. Housing is 44.4% cheaper. If you love the heat and good food, El Paso is a retiree’s dream.

typhoonski / Getty Images/iStockphoto

typhoonski / Getty Images/iStockphoto10. Dallas

Livability: 81

Population 65+: 11.4%

Monthly cost of living with Social Security for homeowner: $1,346

Monthly cost of living with Social Security for renter: $1,142

AdvertisementAdvertisement#_R_2e3ckr8lb2mav5ubsddbH1_ iframe AdvertisementAdvertisement#_R_4e3ckr8lb2mav5ubsddbH1_ iframeDallas is on par with the national average for cost of living. Groceries are slightly cheaper, while healthcare is roughly2% lower, but Dallas has everything from sports to music for retirees to enjoy.

virsuziglis / Getty Images/iStockphoto

virsuziglis / Getty Images/iStockphoto11. Norfolk, Virginia

Livability: 81

Population 65+: 12.6%

Monthly cost of living with Social Security for homeowner: $1,231

Monthly cost of living with Social Security for renter: $1,162

Norfolk has a nice blend of urban and coastal living, a diverse culture and waterfront beauty. Plus it’s affordable — 8.6% lower to live than the national average.

12. Savannah, Georgia

Livability: 81

Population 65+: 14%

Monthly cost of living with Social Security for homeowner: $1,369

Monthly cost of living with Social Security for renter: $1,250

AdvertisementAdvertisement#_R_2gbckr8lb2mav5ubsddbH1_ iframe AdvertisementAdvertisement#_R_4gbckr8lb2mav5ubsddbH1_ iframeKnown for its rich history and striking beauty, Savannah offers a great quality of life at a great price. The cost of living is 9.8% cheaper than the national average while groceries are about 3% lower and healthcare is 4.2% less expensive.

Also See: 4 Ways Trump’s ‘Big Beautiful Bill’ Will Change How You Plan for Retirement

Eva-Katalin / Getty Images

Eva-Katalin / Getty Images13.Orlando, Florida

Livability: 81

Population 65+: 11.1%

Monthly cost of living with Social Security for homeowner: $1,837

Monthly cost of living with Social Security for renter: $1,461

The cost of living for Orlando is 6% higher than the national average, but again the tax breaks help with keeping finances on track. Plus, there’s amazing weather nearly every day and a plethora of things to do: theme parks, outdoor activities and more.

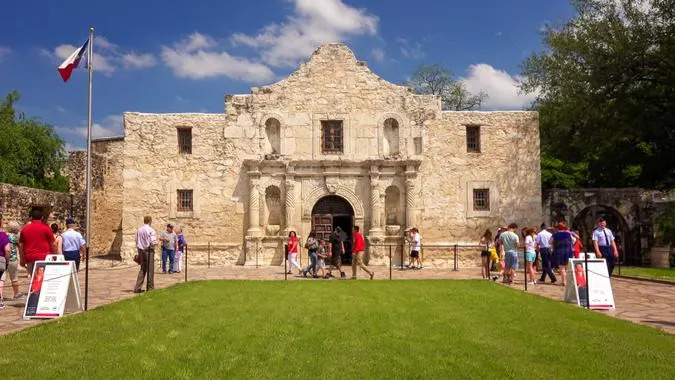

CrackerClips / Getty Images

CrackerClips / Getty Images14. San Antonio, Texas

Livability: 80

Population 65+: 13.1%

Monthly cost of living with Social Security for homeowner: $847

Monthly cost of living with Social Security for renter: $801

AdvertisementAdvertisement#_R_2irckr8lb2mav5ubsddbH1_ iframe AdvertisementAdvertisement#_R_4irckr8lb2mav5ubsddbH1_ iframeWarm weather, friendly locals and affordability are just some of the reasons why people love San Antonio. The cost of living is 8.7% lower than the national average while groceries are 8.6% lower.

Sean Pavone / Shutterstock.com

Sean Pavone / Shutterstock.com15. Corpus Christi, Texas

Livability: 80

Population 65+: 15%

Monthly cost of living with Social Security for homeowner: $736

Monthly cost of living with Social Security for renter: $855

Living near the beach doesn’t have to be out of budget. Corpus Christi has miles of sandy shores and cost of living is an astounding 16.5% lower than the national average.

©Shutterstock.com

©Shutterstock.com16. Daytona Beach, Florida

Livability: 80

Population 65+: 21.4%

Monthly cost of living with Social Security for homeowner: $1,130

Monthly cost of living with Social Security for renter: $1,099

AdvertisementAdvertisement#_R_2l3ckr8lb2mav5ubsddbH1_ iframe AdvertisementAdvertisement#_R_4l3ckr8lb2mav5ubsddbH1_ iframeDaytona Beach is a haven for outdoor lovers. The city has 23 miles of white sandy beaches, fun water sports and a booming boardwalk. Plus, it’s reasonably priced. The cost of living is about 5% cheaper than the national average.

Discover More: 50 Cheapest Places To Retire Across America

Sean Pavone / Shutterstock.com

Sean Pavone / Shutterstock.com17. Athens, Georgia

Livability: 80

Population 65+: 12%

Monthly cost of living with Social Security for homeowner: $1,459

Monthly cost of living with Social Security for renter: $1,116

Known for its vibrant music scene, nightlife and historical charm, Athens is fun and cheap. The cost of living is 12.4% lower than the national average; hlusing is about 20% cheaper.

Kruck20 / Getty Images/iStockphoto

Kruck20 / Getty Images/iStockphoto18. Charlotte, North Carolina

Livability: 80

Population 65+: 10.8%

Monthly cost of living with Social Security for homeowner: $1,794

Monthly cost of living with Social Security for renter: $1,182

The cost of living in Charlotte is just slightly higher than the national average, but the city offers a lot for retirees. It’s family-friendly, has a strong community and is easily accessible to the beach and mountains.

Michael Warren / Getty Images

Michael Warren / Getty Images19. Tampa, Florida

Livability: 80

Population 65+: 13.2%

Monthly cost of living with Social Security for homeowner: $1,737

Monthly cost of living with Social Security for renter: $1,651

The cost of living for Tampa is 4.2% higher than the national average, but retirees can enjoy beautiful weather daily, countless outdoor activities and a slew of free things like the Tampa Riverwalk, fitness in the park, local art and more.

Explore More: America’s 50 Most Expensive Retirement Towns

Jon Mattrisch / Getty Images/iStockphoto

Jon Mattrisch / Getty Images/iStockphoto20. Milwaukee

Livability: 79

Population 65+: 11.8%

Monthly cost of living with Social Security for homeowner: $648

Monthly cost of living with Social Security for renter: $763

Milwaukee is the largest city in the state, so there’s no shortage of amenities. In addition, it’s really inexpensive. The cost of living is 12% lower than the national average — housing is about 44% less.

Kruck20 / Getty Images/iStockphoto

Kruck20 / Getty Images/iStockphoto21. Columbia, South Carolina

Livability: 79

Population 65+: 11.0%

Monthly cost of living with Social Security for homeowner: $886

Monthly cost of living with Social Security for renter: $1,065

One of the many perks of living in Columbia is the cost of living. It’s 12.6% less than the national average — without housing about 42% cheaper.

©Shutterstock.com

©Shutterstock.com22. Midland, Texas

Livability: 78

Population 65+: 10.5%

Monthly cost of living with Social Security for homeowner: $,1389

Monthly cost of living with Social Security for renter: $1,124

Midland has a slower pace of life but a growing arts scene and cheap. The cost of living in Midland is 7.8% below average, with housing coming in at about 10% under.

Find More: The Money You Need To Save Monthly To Retire Comfortably in Every State

Nate Hovee / Getty Images/iStockphoto

Nate Hovee / Getty Images/iStockphoto23. Atlanta

Livability: 78

Population 65+: 12.3%

Monthly cost of living with Social Security for homeowner: $2,085

Monthly cost of living with Social Security for renter: $1,342

Atlanta is a bustling city with endless things to do. The cost of living is 13.3% higher than the national average, largely thanks to an expensive housing market (14.6% higher).

smuconlaw / Flickr.com

smuconlaw / Flickr.com24. New Haven, Connecticut

Livability: 78

Population 65+: 11.7%

Monthly cost of living with Social Security for homeowner: $1,690

Monthly cost of living with Social Security for renter: $1,954

The cost of living for New Haven is 9.2% higher than the national average, but has affordable housing (21% cheaper). In addition, the city is very walkable, has great food and free museums and exciting events.

©Shutterstock.com

©Shutterstock.com25.Lakeland, Florida

Livability: 77

Population 65+: 21.8%

Monthly cost of living with Social Security for homeowner: $1,294

Monthly cost of living with Social Security for renter: $1,208

Lakeland has a small-town feel with nice neighborhoods and an inexpensive cost of living. It’s 8.4% cheaper than the national average — housing is about 24% cheaper.

Methodology: For this study, GOBankingRates analyzed U.S. cities to find the best places where you can retire in great weather for $2,000 a month. GOBankingRates found cities with the best weather, sourced from 24/7 Wall St.’s “U.S. Cities with Absolute Best Weather,” FarmersAlmanac.com’s “The 10 Best U.S. Weather Cities,” Cutter.com’s “U.S. Cities with Best Weather,” RealEstate.USNews.com’s “Best Places to Live in the U.S. for the Weather” and Grillio.com’s “Top U.S. Cities for Weather.” Other data was sourced from the U.S. Census American Community Survey, Sperling’s BestPlaces, the Bureau of Labor Statistics Consumer Expenditure Survey, Zillow Observed Value Index, Zillow Home Value Index for May 2025, the Federal Reserve Economic Data and the Social Security Administration’s Monthly Statistical Snapshot. Livability index was sourced from AreaVibes. The cities were sorted to show the highest livability location. All data was collected on and is up to date as of July 14, 2025.

More From GOBankingRates

6 Costco Products That Have the Most Customer Complaints

Mark Cuban Warns of 'Red Rural Recession' -- 4 States That Could Get Hit Hard

Warren Buffett: 10 Things Poor People Waste Money On

Mark Cuban Says Trump's Executive Order To Lower Medication Costs Has a 'Real Shot' -- Here's Why

This article originally appeared on GOBankingRates.com: 25 Cities Where You Can Retire in Great Weather for $2,000 a Month