3 Finance Stocks to Buy Ahead of Q2 Earnings: BLK, BK, STT

The financial sector will take center stage next Tuesday, July 15, with Q2 results from most of the major domestic banks set to be released.

Underlying the spotlight, several of these finance stocks currently sport a Zacks Rank #2 (Buy) ahead of their quarterly reports and are worthy of consideration outside of the three big banks that will be reporting, which include JPMorgan JPM, Citigroup C, and Wells Fargo WFC.

Major Regional Bank Stocks to Consider

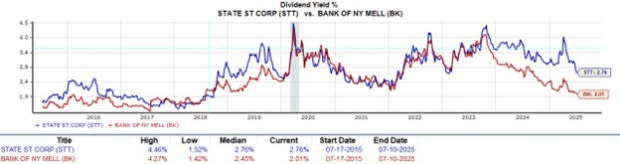

At the moment, the Zacks Banks-Major Regional Industry is in the top 5% of over 240 Zacks industries, with State Street STT and The Bank of New York Mellon BK being two standouts.

As renowned holding companies, both provide a wide range of financial products and banking services for institutional investors, including high-net-worth clients. Furthermore, State Street and New York Mellon are expected to post double-digit EPS growth in fiscal 2025 and FY26, with their Q2 reports expected to reflect 10% and 15% earnings growth, respectively.

Steady sales growth also suggests State Street and New York Mellon will be able to sustain their industry-leading operational efficiency, with STT and BK recently hitting new 52-week highs and offering respectable dividend yields that are over 2%.

Image Source: Zacks Investment Research

BlackRock - The Leading Investment Management Firm

As the world’s largest asset manager, BlackRock’s BLK expansive growth is expected to continue when the company reports its Q2 results next Tuesday. Having more than $11 trillion in assets under management (AUM), BlackRock’s quarterly sales are thought to have increased 12% year over year to $5.38 billion, with Q2 EPS expected to rise 5% to $10.86.

Notably, BlackRock’s Zacks Financial-Investment Management Industry is currently in the top 20% of all Zacks industries. Glamorizing its industry dominance, BlackRock’s annual earnings are slated to rise 5% this year and are projected to increase another 12% in fiscal 2026 to a whopping $51.75 per share. This is accompanied by expectations of 11% sales growth in FY25, with BlackRock’s top line projected to expand another 15% in FY26 to $26.16 billion.

Image Source: Zacks Investment Research

Hovering near a 52-week high of over $1,100, BlackRock stock offers a generous 1.89% annual dividend yield that equates to $20.84 per share. More intriguing, BlackRock’s 46% payout ratio suggests there is plenty of room to boost its dividend in the future, especially considering the company’s superior operational performance.

Image Source: Zacks Investment Research

Bottom Line

Ahead of their Q2 reports on Tuesday, July 15, these top-rated finance stocks look poised for higher highs. Correlating with their Zacks Rank #2 (Buy) rating, State Street, The Bank of New York Mellon, and BlackRock stock have benefited from a pleasant trend of positive earnings estimate revisions for FY25 and FY26, suggesting more upside ahead.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

BlackRock (BLK) : Free Stock Analysis Report

State Street Corporation (STT) : Free Stock Analysis Report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research