Asia Morning Briefing: Nvidia’s Rally to $4 Trillion Might Have Helped BTC, But Correlation Is Waning

Good Morning, Asia. Here's what's making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk's Crypto Daybook Americas.

Nvidia's ascent to a historic $4 trillion market cap, the first-ever company to achieve this milestone, might be exactly the catalyst bitcoin (BTC) needed to break out of its tightly coiled trading range and surge toward new all-time highs, addressing analysts' concerns that the crypto market lacked a clear driver.

BTC is currently trading at $110,900, according to CoinDesk market data, after rallying during the U.S. trading hours to over $111,000 and briefly touching all-time high.

Glassnode analysts had previously described Bitcoin’s recent market activity as quiet, characterized by declining on-chain transactions, minimal miner revenues, and suppressed fees.

Rather than interpreting these factors as bearish indicators, Glassnode highlighted a mature market increasingly dominated by large-value institutional transactions and cautious long-term holders.

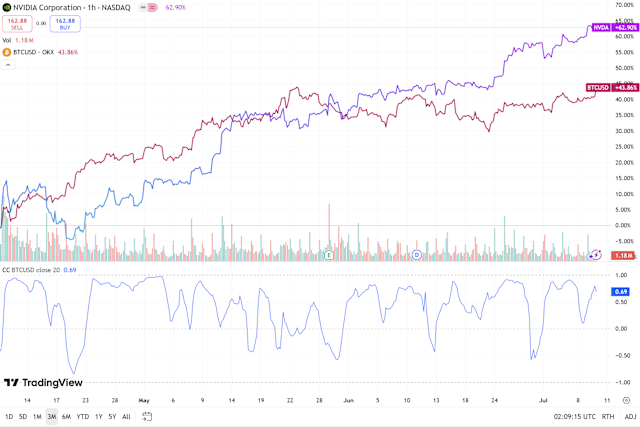

All this being said, the correlation between Nvidia and BTC might be short-lived as data suggests its weakening.

While the correlation between the GPU giant and BTC peaked above 0.80 during the AI-driven euphoria of early 2024, and the three-month average remains relatively strong at 0.69, the latest data shows a dip to around 0.36, indicating a possible decoupling as investor focus shifts.

Still, Nvidia’s milestone seemed to serve as a potential trigger for BTC breakout from weeks of price inertia.

However, it's possible that Nvidia's share prices might correct at some point, given its volatile nature. But this weakening correlation means that BTC price might remain resilient – when that day comes.

Australia Begins Real-World CBDC Tests

Australia’s central bank digital currency (CBDC) initiative, Project Acacia, has entered its next phase as the Reserve Bank of Australia names 24 industry participants selected to trial real-world applications of digital money in tokenized asset markets.

Spearheaded by the Reserve Bank of Australia and the Digital Finance Cooperative Research Centre, the project brings together major banks, fintechs, and infrastructure firms to trial programmable digital money in real-world financial workflows.

The pilots will explore settlement across asset classes such as bonds, carbon credits, private markets, and trade receivables.

Nineteen projects will involve live transactions, while five will remain at the proof-of-concept stage. ASIC has granted targeted regulatory relief to allow testing with real assets, continuing its approach of enabling responsible innovation in digital finance.

繼續閱讀While Australia is pushing ahead with further CBDC development, the Bank of Canada has shifted its focus away from developing a retail CBDC, amid mounting criticism that such a system could enable government surveillance by allowing authorities to monitor every transaction, unlike the anonymity offered by cash.

Market Movements

BTC: Bitcoin hovered near $109,000 as institutions defended key support levels amid light resistance at $110,000, showing resilience despite dormant wallet activity and regulatory uncertainty, while macro conditions such as a weakening dollar and steady rate cut odds bolstered corporate appetite for risk assets, according to the CoinDesk market insights bot.

ETH: ETH closed a volatile 23-hour session up 2.8 percent, with strong institutional volume and resilience above $2,650 signaling continued bullish positioning amid market uncertainty.

Gold: Gold prices extended losses for a second day, hovering near $3,285 as reduced July Fed rate cut bets, a strong U.S. dollar, and firm Treasury yields pressured the metal, though trade tariff concerns and upcoming FOMC minutes helped limit further downside.

Nikkei 225: Asia-Pacific markets opened mixed Thursday as investors weighed the Bank of Korea’s rate hold and U.S. President Trump’s move to impose a 50% tariff on Brazilian imports, citing unfair trade and retaliation over Bolsonaro’s prosecution, with Japan’s Nikkei 225 down 0.45%.

S&P 500: Stock futures were mostly flat Wednesday evening after the S&P 500 clawed back some losses from this week’s tariff-driven decline, with Dow futures slipping just 37 points.

Elsewhere in Crypto

-

U.S. Digital Assets Tax Policy Getting Hearing During 'Crypto Week' (CoinDesk)

-

Pump.fun plans 25% revenue share with token holders: Sources (Blockworks)

-

Judge Recommends Dropping Logan Paul’s Ex-Assistant From 'CryptoZoo' Lawsuit (Decrypt)