Oil and Gas Consolidation Reshapes African Market

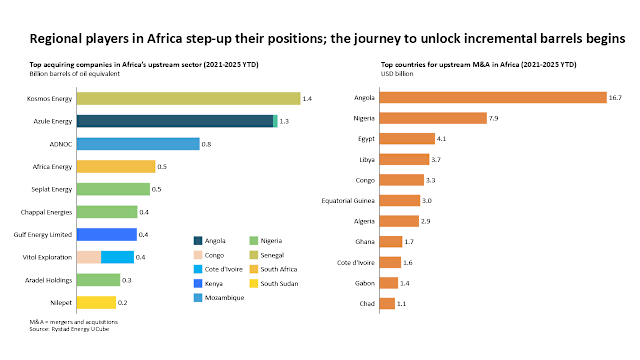

Africa’s upstream oil and gas sector is undergoing a transformative shift. In recent years, majors have scaled back their exposure to mature, non-core assets across the continent, opening the door for a new wave of regional independents, traders, and non-African national oil companies (NOCs) to step in as consolidators and value creators.

Angola and Nigeria have been the epicenters of this consolidation wave. Angola saw the formation of Azule Energy through the BP-Eni portfolio merger, where the new independent has already created value by reversing the declining production trend by investing more actively in the portfolio. The emergence of nimble, focused companies like Afentra, Tende Energy, and Etu Energias in Angola reflects a broader trend. These budding players are committed to tapping into incremental contingent resources, thereby extending field life.

Nigeria on the other hand has witnessed the exits of Shell, Eni, and TotalEnergies from their onshore positions, and Equinor’s divesture of its offshore assets. This led to indigenous companies such as Seplat Energy, Renaissance Energy and Chappal Energies growing their footprints extensively. These companies’ focused efforts to invest further in the portfolios and unlock the contingent resources could be a game changer for Nigeria at a time when it has set ambitions to surpass its oil production beyond 2 million barrels per day (bpd) in the short term and 3 million bpd in the long term.

One key change in Nigeria’s upstream player landscape has been the indigenous companies taking on the operatorship of key producing blocks. If the short-term production growth targets are met, this will be a great turnaround for the country and will place confidence in the operational execution for the new entrants.

Pranav Josi, Vice President, Africa Oil & Gas

Beyond traditional exploration and production (E&P) firms, traders and non-African NOCs are also stepping up their Africa game. ADNOC’s XRG, through its Arcius Energy joint venture with BP, is now active in Egypt and has also entered Mozambique through the acquisition of Galp’s stake in the Area 4 development. Brazil’s Petrobras is also actively looking at opportunities in the Atlantic margin after picking up an exploration block in South Africa. Malaysia’s Petronas took a stake in Angola’s Kaminho cluster in 2023, while Houston-based Vitol bagged 2025’s first major trader-led upstream acquisition involving assets in Côte d’Ivoire and Congo-Brazzaville.

We have already started seeing announcements such as Renaissance’s investment in Nigeria of $15 billion over the next few years. At a time when countries such as Nigeria and Angola are evolving their regulatory and fiscal frameworks to attract investment, the exchange of hands from majors to regional players that understand the local communities better could not have come at a better time. The timely execution and clear development of roadmaps will be critical to trigger a new cycle of production growth. For Africa’s upstream sector, the table is set—what follows will depend on decisive action by its newest custodians.

Story continuesBy Pranav Joshi, Vice President, Africa Oil & Gas at Rystad Energy

More Top Reads From Oilprice.com

-

Pentagon Shifts Stance on Ukraine Military Aid

-

Central Asian States Reconnect with Afghanistan

-

Nippon Steel Acquires U.S. Steel After Prolonged Battle

Read this article on OilPrice.com

![India Electric Commercial Vehicle Market [2029] Key Trends and Strategies for Expansion](http://www.paseban.com/zb_users/upload/2025/08/20250831201809175664268958996.jpg)

![North America Automotive Air Filters Market Trends [2028]- Exploring the Dynamics of Industry](http://www.paseban.com/zb_users/upload/2025/08/20250831082650175660001038819.jpg)

![Plasticizers Market - A Comprehensive Report [2028]](http://www.paseban.com/zb_users/upload/2025/08/20250831062111175659247110296.jpg)