Bitcoin smashes record high but greed remains in check

Bitcoin smashes record high but greed remains in check originally appeared on TheStreet.

Bitcoin's price surged past $118,000 on July 11, a new all-time high for BTC. In particular, this rally saw $2.42 billion in shorts liquidated, the highest daily loss for shorts in more than 2 years.

The Glassnode Long-Term Holder Net Unrealized Profit and Loss (NUPL) ratio is currently at 0.69, below the "Euphoria Zone," which is identified as being >0.75. This means that most holders are in profit, but we are still not in the range of establishing extreme greed.

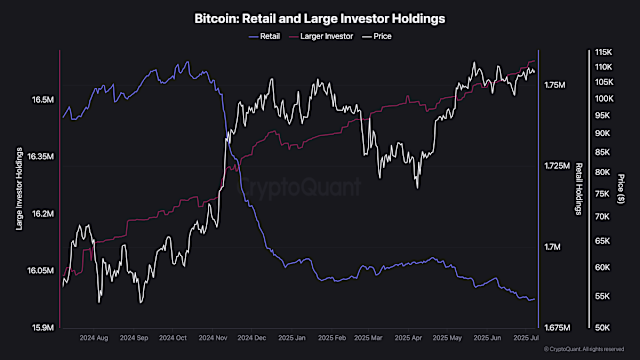

Julio Moreno, the Head of Research at CryptoQuant, emphasized the low selling pressure that accompanied the price increase. "Total daily Bitcoin exchange inflows are at an unsettling low: 18,000 BTC, the lowest amount since April 2015."

Moreno pointed out that whales or large holders (100+ BTC) activity has drastically reduced from 62,000 BTC on Nov. 26, 2024, to approximately 7,000 BTC as of June 2025.

This kind of trend is seen throughout the crypto ecosystem. Ethereum (ETH) exchange inflows are down to 584,000 ETH from 1.57 million ETH in February, even with the asset recovering 87% from the lows in April.

As of press time, Ethereum is trading at $2,955.94, up nearly 7% in the last 24 hours, as per Kraken.

XRP whale inflows are also down 85% from their February highs. Altcoin inflows, which usually have a large spike at market tops, are still very low at 21,000 transactions per day compared to around 120,000 transactions across the same altcoins in previous local peaks in March and December, as per analyst Moreno.

Bull run not driven by speculative mania

Further, the Spot Volume Bubble Map from CryptoQuant indicates that Bitcoin is approaching its all-time highs, but the market does not appear to be overheating.

The current rally appears to be much calmer than the wild bull runs of late 2017 and early 2021, when the market displayed obvious signs of overheating.

Instead of hype, the majority of trading activity now shows signs of consistent buying, indicating that long-term investors rather than short-term speculators are driving this increase.

Bitcoin smashes record high but greed remains in check first appeared on TheStreet on Jul 11, 2025

This story was originally reported by TheStreet on Jul 11, 2025, where it first appeared.